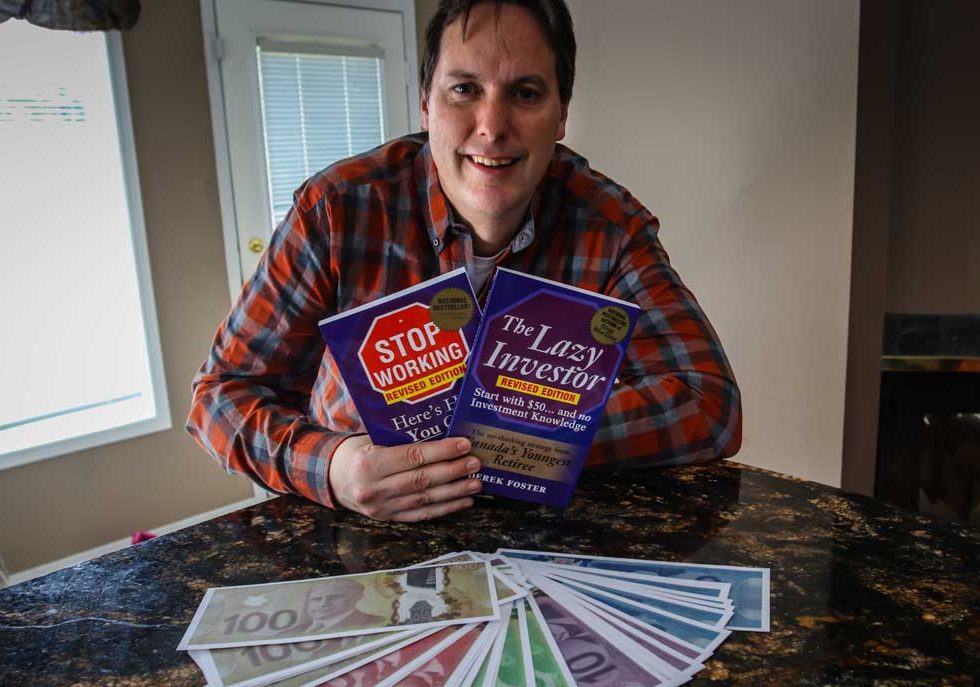

(Photo by Barry Gray.)

While most people wouldn’t take pride in calling themselves an idiot, Stittsville’s Derek Foster does. But for an idiot, he’s pretty smart. He is a best selling author six times over, including his book “The Idiot Millionaire”. He created investing strategies that allowed him to “retire” at 34 years old.

(Although he says he’s retired, he does to continue to write, promote, and sell his books.)

His strategies come from being self-taught through reading other people’s books as well as trial and error. That led Foster to create investment strategies that he says are so simple that a six-year-old can understand them, which makes sense because Foster’s interest in investing started when he was just a child.

“When I was about – maybe seven – I played Monopoly a lot,” says Foster. “The idea that you can sell and buy hotels and make money off it interested me.”

When Foster was 18 years old, he read The Wealthy Barber by Canadian author David Chilton, furthering his interest in money and investing and helping develop his investment strategies.

In the mid-1970s, Foster’s father owned a used appliance business in the building that’s now home to Quitters Coffee on Stittsville Main Street.

Foster spent his 20s backpacking through Europe, Australia and New Zealand before working in Asia for several years.

“I’ve never really had a high paying job,” said Foster.

Financial success came from the stock market – from investing and living off the dividends.

“People think the stock market is rigged against you,” Foster said. “But it’s not.”

Foster doesn’t like things that are hard to predict. Instead, he encourages people to look around them and everyday things.

“Keep things simple – the things you throw in the [grocery] cart every week, the bills you pay every month,” said Forster.

He gives the example of toothpaste. People always brush their teeth, so established toothpaste brands will always sell. Foster often uses the Colgate company as an example. The stocks have paid dividends for the past 100 years and have increased every year over the past 50 years.

That leads to Foster’s number one investing tip: “Investing should be simple,” said Foster. “If it’s not simple enough for a six-year-old to illustrate with a crayon, don’t buy it.”

Foster’s own stock portfolio includes Pepsi, Bell, and Restaurant Brands (which includes many businesses including Tim Horton’s). It’s all about the common things.

“People use it every day – there is repetitive use of business,” said Foster.

Following his own advice has given Foster the flexibility so stay home with his wife and seven (soon to be eight) children who range in age from 2 to 17 years old.

To learn more about “The Idiot Millionaire” or to purchase his books, visit his website, stopworking.ca.

The millionaire’s favourites:

- Food – Shawarma

- Drink – “I’m really boring. I only drink water.”

- Guilty Pleasure – CFL Football – Ottawa Redblacks fan “I watch all the games”

- Travel Destination – Australia or anywhere warm

- Thing about Stittsivlle – “It’s very bikeable and walkable – especially with the Trans Canada Trail.”

Derek isn’t retIred. He lives off his book sales and government child benefits. He abandoned the investment strategies he espouses in his books in 2009 when the markets were falling. And he recommended selling put options, something no retail investor should dabble in. Bottom line he is selling half truths about retiring at 34.

Yes,

You left out the fact he made a highly leveraged bet on a global multinational company that allowed him to sell and then retire. He never espouses that same strategy to others. Matter of fact he never talks about how that one bet allowed him to retire. Why doesn’t he recommend others borrow money to invest? Because of one word RISK!

He would rather conveniently tell you what he’s doing now not how that bet got him to where he is. Most people can not duplicate this strategy. He also loves to call himself an idiot and lazy. It’s really an over simplification of who he is and what he does.

He has never stopped working and he is NOT retired.

I have read ALL of his books. Reading is what I do.(I’m retired but am looking for a business etc.)

I’ve got a plan which involves dividends. I buy by selling a put at a price that grantees a dividend yield of 10%. I then sell covered calls or LEAPs at a very large price. So for I haven’t sold any stock.

Yours truly,

Samuel Bruce Campbell

PS: I retired at 61.